The pandemic is accelerating many of the underlying advertising, media, and commerce trends that were slowly bubbling to the surface. We’re experiencing rapid shifts in global consumer behavior - an experience we’re sharing collectively, yet alone - away from our regular pre-pandemic social lives. Some of these shifts may be temporary, but many will stick around - we’ll digest which ones are most relevant for brands, media owners, consumers, and other relevant constituents, all through the lens of content and experiences we like to consume the most. Over the previous two weeks we tackled sports & entertainment. Today’s third (and final) installment focuses on commerce.

It feels like we just wrote about the great e-commerce acceleration of 2020; we did -- a mere 10 weeks/10 Ones ago. Time moves strangely in pandemics. A lot has happened in the world of commerce in a matter of just a few weeks.

Some highlights:

Amazon reported their Q2 earnings (a day after Congressional antitrust hearings none the less) and had a truly monster quarter. Q2 saw Amazon increase 40% YoY and double net profit in the same period to a new record of $5.2 billion. What’s most impressive is that this followed a rather sluggish start: even Amazon’s finely tuned logistics* machine was temporarily challenged by pandemic-induced increases in demand. Early delays in delivery times opened a door for competitors: as Amazon’s web traffic fell, rivals including Walmart, Target, Best Buy, and Costco saw their traffic increase as consumers looked for reliable alternatives (Costco, the laggard among e-commerce adoption, saw traffic increases exceeding 200% YoY).

There’s that sweet V-shaped recovery.

Over in the traditional retail sector the only records being shattered seem to be in the number of Chapter 11 filings. According to RetailDive, 23 retailers have filed for bankruptcy by the end of July, including a slew of storied brands like Neiman Marcus, Brooks Brothers, J.C. Penney, Ascena (Ann Taylor), and J. Crew. Apparel brands and department stores fare the worst - unsurprisingly, this is another slow decline trend that is being accelerated by the pandemic. The combination of a large (expensive) physical store footprint and no foot traffic is proving to be deadly.

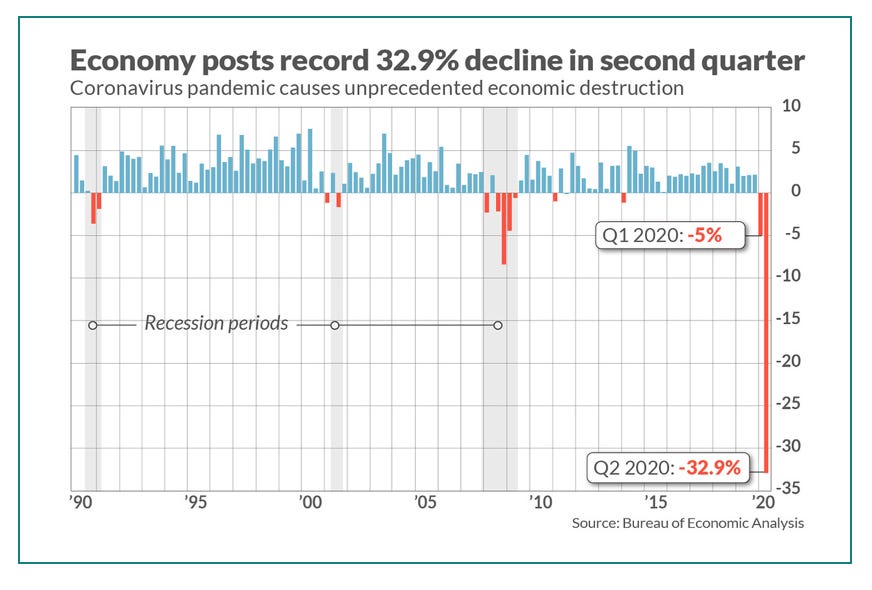

On a macro scale, the US economy posted a staggering yet perhaps unsurprising 32.9% decline in Q2. Consumer spending similarly cratered by an unprecedented 34.6%. Households spent 11.3% less on purchases and only on essentials like groceries, cars (the only viable transportation option in most of the country), health care, and household goods (perhaps to accommodate an influx of new work-from-home knowledge workers).

A rather depressing graph, isn’t it? Forrester estimates that the US retail sector can expect losses to the tune of $321 billion in 2020 and that it may take 4 years to get back to pre-pandemic sales figures (not counting the business casualties we’ll lose along the way).

With traditional retail and the economy-at-large sputtering in the US, it’s a good time to be an e-commerce SaaS solution. Selling shovels during a gold rush, as one of Silicon Valley’s favorite adages tells us, is always a reliably lucrative option. The most recent example of this is this week’s BigCommerce’s IPO: the Austin-based company has 60,000 global clients and offers an e-commerce platform. Priced at $24 prior to open, the stock hit a high of $93.99 and raised more than $200 million. (Let’s save the topic of why are tech/SaaS IPOs so frequently underpriced for a different One).

It’s pretty clear that commerce today really means e-commerce and the other alternative seems to be bankruptcy.

Why should you care?

With everyone being an e-commerce business now, what are the key adaptations one must make to succeed? This will, of course, vary depending on the vertical you’re in: some sectors, like travel, are slow to rebound and depend heavily on local COVID response. If you have a marketing budget to spend or an audience to attract, what are you to do?

First off, your customer acquisition funnel may now look very different than it did just a few months ago. The initial ad spend pause in March when advertisers went skittish may have created some short-term opportunities to get in front of your audience through paid methods (especially if your main audience acquisition relied on Facebook, Google, and platforms). Facebook CPMs had fallen 30-50% in March (higher in regions particularly affected by the pandemic) but seem to have largely stabilized, if not fully recovered by the tail end of July. Flagship stores don’t have the same marketing appeal now: at least not in areas that are still struggling with COVID-19 containment. That TV budget may work better in AVOD/CTV scenarios, assuming you have the flexibility to shift. Your analytics team is your ally here for rapidly pulling data to understand which channels are new customers coming in from and have repeat customers changed their purchase frequency or order size. This is also a good time to attempt re-activation campaigns and appealing to loyalty/rewards members (all this assuming you have direct channels to your customers or at the very least an email newsletter). You may rapidly realize that your tech stack, configured for the in-person commerce world, is not up to snuff and that you need to re-tool it or that you’re not able to readily track the right KPIs. It may prove counterintuitive to seek additional investment in a time of crisis, so we recommend engaging in building a business case for e-commerce first, with assumptions and projections taking into consideration a prolonged period of time before regular, pre-pandemic patterns can resume. If you’re a retailer whose online activity has been reliably increasing (or skyrocketing like in Costco’s case) you may want to consider launching a media business (we touched upon this option and its challenges in another recent issue of One about self- serve advertising platforms).

If you rely heavily on in-person/in-store experience, you may want to rapidly embrace video commerce. With stores closed, how can you still let your customers try things out in person? A great example came from premium home fitness makers Tonal: with only 9 physical store locations, they rely on demonstrating the equipment via 25-minute Zoom appointments. The whole experience is wonderfully easy and authentic: you pick a date/time, a tonal employee calls in, demonstrates the equipment, answers any questions you may have, and generally sets you up with all the information you need should you want to proceed with your order (over email, after your call). This kind of experience isn’t solely in the realm of nearly $4k high-end fitness equipment sellers. As an initial response to the pandemic and in concert with its ‘Play inside, play for the world’ campaign, Nike made its Nike Training Club premium app free. The app, which normally cost $120 per year or $15 per month, offers a variety of fitness programs and training plans with many hosted by Nike’s marquee athletes. They’ve since made what was meant to be a temporary fee reduction permanent: the app features a link to Nike’s online store; if the workouts become a regular habit for their users, how much exposure does that generate for Nike’s products? What seems like an obvious yet still missing connection is to be able to one-tap buy the gear that you see instructors wearing in a video. Perhaps social commerce (a la Chinese phenom Pinduoduo) or retail streaming (the ‘as seen on TV’ label for the digital age) are next on deck.

Possibly the most difficult hurdle to overcome if you’re not a digitally native vertical brand is that order delivery (and return) experience is part of your brand. You can do everything else right -- from advertising, through product design, quality, and price -- if you fail at the very last step of delivery and unboxing, your customer will not be happy. There’s certainly a temptation to underinvest in this part of the shopping experience especially if you’re a traditional retailer and aren’t used to direct channels. A recent experience with a beloved high-end clothing brand drove this point home: their order arrived in a ragged box, sans the customary garment box that was a prominent feature of their in-store experience. The return process can best be described as a cross between National Treasure and Mission Impossible: it involved calculating postage, locating a printer to print out the label, repackaging from original ridiculously oversized delivery box (that would have broken the bank to ship back), and complex math to decipher which returns center to ship it to. The credit is taking its sweet time to process, too. The company would do well to write a book on how to lose a loyal, multi-year customer in one order.

Finally, if your brand relies heavily on in-person experience your online offering doesn’t have to be a poor clone of your physical one. You can (and likely should) create a different experience. The key here is to look for what can be additive while utilizing the resources you already have. For big box stores like Best Buy or Target, curbside pickup is a good option for both stores and consumers (as a side note, we finally seem to be retiring BOPIS, the worst acronym in business, in favor of the more palatable ‘curbside pickup’ or ‘in-store pickup’ and this alone is a cause for celebration). The boutique fitness chain OrangeTheory had an interesting challenge on their hands: the high-energy instructors and specialized equipment that characterizes their in-studio experience won’t be available in member homes; their initial pandemic plan to distribute daily workouts to members via PDFs was thankfully vetoed by the CEO. Instead, Orange Theory delivered a cute, authentic set of video workouts featuring instructors working out with a variety of alternative equipment. Don’t have a 30 lbs kettlebell handy? How about a wiggling baby?

Knowing what makes your customers tick is key to success here - and once again analytics, customer experience, and research all play a part in your ability to execute. If you don’t readily have access to those (yikes, why not?!), a good bet to take is to flex your curation muscles. Digital commerce is a world of abundance with no shelf-space constraints or availability challenges. While customers have an infinite supply of choices they don’t have an infinite supply of time. When Russo’s, a gourmet grocery in Boston, was faced with managing the pandemic they launched a set of pre-packaged boxes of essentials that you could order online and pick up during your pre-arranged time-slot from their parking lot. Instead of having folks wander about the store in the early days of the pandemic, the store would do the work for you.

What started as a low-tech listing of what you can expect in each box has evolved into a Shopify cart and a variety of topical boxes (including things like ‘victory garden herbs’ that you can plant or ‘make your own collection’ that you can gift to friends). The experience is so good that it’s likely to stay longer-term - and the online store sports 20 (!) different box configurations today.

Other cool examples across verticals come to mind, but let’s not belabor the point. What characterizes most of the successful examples is thinking outside the proverbial box of regular operations. In some cases that means forming a tiger team that can make decisions quickly, in others it means investing in parallel e-commerce oriented technology, and in all it means really understanding why your customer is your customer in spite (or perhaps because of) other readily available options.

One question:

We’re rapidly approaching marquee shopping events like back to school in a year where it isn’t exactly clear whether students in the US will be returning to school in person; even if they do, it’s likely they’ll need a different selection of things than in a ‘regular’ year. Walmart and Target have both announced they’ll be closed on Thanksgiving but there isn’t much clarity around the day after: Black Friday, traditionally a significant shopping event (named for the first day in the year that retailers are likely to be in the black vs in the red in more stable times). Even Amazon’s Prime Day has been postponed from July to December. How can advertisers and brands adapt their shopper holiday budgets and messaging in time to attract consumers to their (alt) e-commerce offerings and optimize for KPIs that are in flux?

Dig deeper:

Amazon’s great quarter and selection of interesting charts

BigCommerce’s big debut

Book a Tonal demo for yourself - it’s worth the experience

Nike’s excellent Play for the World campaign

Breakdown of OrangeTheory’s rapid adaptation approach

Try OrangeTheory at home yourself

Each week we curate a selection of the most interesting (free) events in adtech, martech and friends - check it out here.

Enjoyed this piece? Share it, like it, and send us comments (you can reply to this email).

Who we are: Sparrow Advisers

We’re a results oriented management consultancy bringing deep operational expertise to solve strategic and tactical objectives of companies in and around the ad tech and mar tech space.

Our unique perspective rooted deeply in AdTech, MarTech, SaaS, media, entertainment, commerce, software, technology, and services allows us to accelerate your business from strategy to day-to-day execution.

Founded in 2015 by Ana and Maja Milicevic, principals & industry veterans who combined their product, strategy, sales, marketing, and company scaling chops and built the type of consultancy they wish existed when they were in operational roles at industry-leading adtech, martech, and software companies. Now a global team, Sparrow Advisers help solve the most pressing commercial challenges and connect all the necessary dots across people, process, and technology to simplify paths to revenue from strategic vision down to execution. We believe that expertise with fast-changing, emerging technologies at the crossroads of media, technology, creativity, innovation, and commerce are a differentiator and that every company should have access to wise Sherpas who’ve solved complex cross-sectional problems before. Contact us here.